Overview

Zimbabwe has been mining ferromanganese ore and exporting the bulk of it without real beneficiation added value at source. This has thus led to the ferromanganese industry, and at large, the steel industry remaining subdued and low keyed when considering the level of abundance of key steel resources in country.

There is sufficient scope in Zimbabwe to produce Ferromanganese Alloys and related manganese chemicals. This is derived from the current 20-000tons/month mine capacity for the ore. At this rate, it is possible to create a USD78Million/year turnover business, upon the investment of USD15Million on the processing technology. The cash flow projections can absorb up to 30% interest on capital. Provisions for the operational expenses amounting to USD37Million for the first year might be required at a rate of USD3.06Million/Month until the project can self finance, which is effectively upon the sale of the first month’s production, estimated at USD6.5Million/month.

Processing Technologies

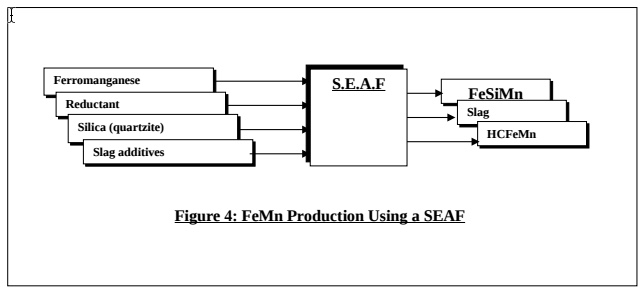

The production of Manganese alloys is done using carbothermic processes for which the temperature can be attainable using an electric arc in a Submerged Electric Arc Furnace (SEAF – Figure 4 below) or a shaft furnace. The two principal alloys are High Carbon Ferromanganese (HCFeMn) and Ferro Silico Manganese (FeSiMn) and these can be economically produced using ores mined in the country.

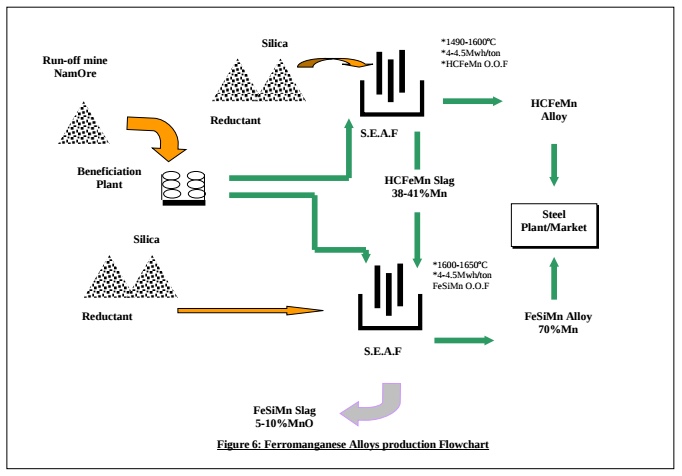

While the production of HCFeMn is achievable using run-off mine ore, it yields a slag relatively rich in manganese oxides that can be used as part of the process input into the Ferrosilicon Manganese production process. Using the SEAF Technology, the production process based on the standard Bourdouard reaction for oxides reduction:

MnOx + xC —–>Mn + CO(g)

However, the kinematics requirements result in the excessive deportment of the unreduced species of MnO into the HCFeMn slag. It therefore becomes necessary to include a process that will scavenge the Manganese in the slag and in the process produce Ferrosilicon Manganese.

Manganese Alloys Production

Several assumptions have been made as drawn from the process flow. These assumptions are:

- Beneficiated run-off mine amounts to 20 000t/month, which is approximately 240 000tpa.

- Run-off mine shall be beneficiated using HMS techniques from +/-38% Mn oxides to +52% Mn oxides content.

- The adopted system shall consist of two units producing HCFeMn and FeSiMn alloys.

- Run-off mine shall yield HCFeMn alloy using 4-4.5Mwh/tonne of alloy at 1600oC maximum process temperature.

- HCFeMn process recovery will be 73%, yielding alloy with X% Mn and 38% MnO in slag.

- For the production of FeSiMn, an appropriate Ore/Slag ratio can be varied according to desired outputs and customer specifications.

Based on the above assumptions, two 15MVA furnaces to yield 3.3Mt/hr of HCFeMn and 3.3Mt/hr of FeSiMn can be adopted for the 20 000t/month of ore.

Production Process

Primary Process: Metal Oxide + Reductant Energy FerroMetal + Reductant oxide + Unreduced oxides

The energy is electricity and carbon from charcoal, coke, coal or anthracite as the reductant.

Raw Materials

The raw materials matrix for the production (see flowchart Figure 6 below) of HCFeMn and FeSiMn includes the following:

- Ferromanganese ore

- Silica (Quartzite)

- Reductant

- Slag additives.

Financials

Capital Expenditure Requirements (Capex Model)

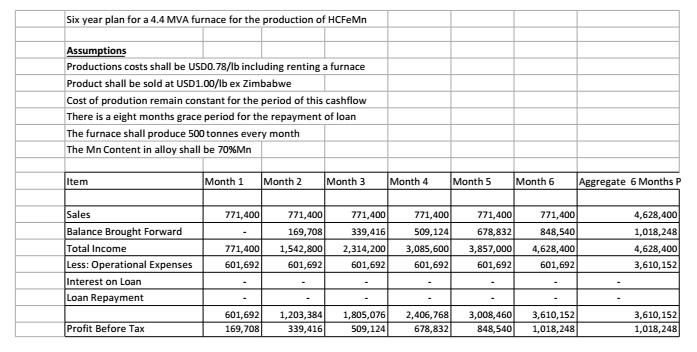

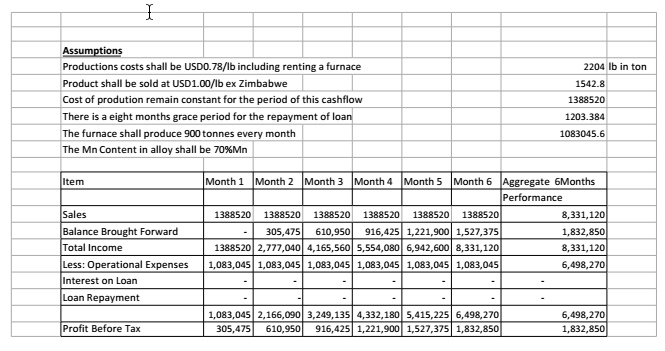

Investment into 1MVA (Unit Cost) has been estimated and determined to be between USD0.3-0.5Million. See below 4.4MVA furnace production assumptions:

It is required to install a combined capacity of 30MVA, ultimately USD15million may suffice to purchase, install and construct the necessary structures for the smelting of the ores.

Operational Expenditure Requirements (Opex Model)

The proposed model is based on the Best Available Techniques in the operation of a SEAF. Specific cost drivers are dedicated to ideal and standard operational values. This is based on previous experiences from elsewhere and the use of internationally accepted standards (Benchmarking) in the ferro-alloys industry.

Projected Cash Flow

The 15MVA projected cash flow model was derived basing on several assumptions. Assumptions to the projected cash flow (see below a 6.3MVA furnace for the production of HCFeMn assumptions):

- The operational cost model of the 15MVA capacity will be uniform for both HCFeMn and FeSiMn.

- The unit cost of production for both products, in terms of the tonne unit output shall remain at USD700 for the budget period.

- The selling price for the product shall be USD1200/unit ton marketed.

- Corporate tax for the Company shall be favourably on the Net Profit After Tax, the Net Profit Before Tax was used in all calculations.

- The inflationary conditions in Zimbabwe have been disregarded by calculating all costs in the USD currency, a more stable way to evaluate the expected financial performance.

-

There is a 2-year grace period on loan repayment, and the interest on the loan is 30% maximum per annum.

TOLLING

The plant has a capacity to produce 600t per month of Ferromanganese alloy with an input feed ratio to output being 3:1 from a 6.3MVA capacity smelter. This is enough to generate the appetite to build a plant nearer the raw material as the boarder with Mozambique is 60km from mine and 460km to Beira port, making it easier to move the bulk material to port.

Purchase of ore, raw materials and production which includes electricity is pegged to be the equivalent of 68c to 70c p/lb plus 5c p/lb royalties for tolling, while CIF price China for HCFeMn is USD98c p/lb meaning there is a difference of 23c p/lb, we then divide this by half to get to 11c p/lb for any drastic macro or micro changes at a capacity of 600t. At best case scenario the margin is 30.6% while at worst case scenario its half of this. In real figures we pegging a turnover of USD907,413 @98c p/lb with profit before tax of USD212,964 @23c and half of this respectively at 15% return.